Capstone’s Abigail Iaconis Earns MMP Certification

Capstone’s Abigail Iaconis Earns MMP Certification Capstone Strategic is pleased to announce that Senior Analyst Abigail Iaconis has received her certification as a Middle-Market Professional (MMP) from the Association for Corporate Growth. In order to receive the MMP certification, students must complete a 4-to-6-week self-study course, and successfully pass an exam. The program covers the …

Capstone’s John Dearing Shares Thoughts as Part of Strategic Growth White Paper

Capstone’s John Dearing Shares Thoughts as Part of Strategic Growth White Paper Capstone Partner John Dearing provided expertise and insight for a recent white paper published by America’s Credit Unions’ CEO Council. Leveling Up: Leadership Through Asset Size Growth examined ways to potentially increase credit union asset size through both organic and inorganic growth. Dearing …

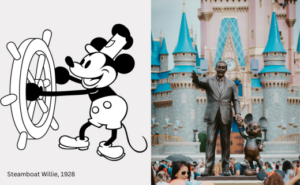

When Your Wish Can Go Too Far

When Your Wish Can Go Too Far How problematic acquisitions and lack of a clear strategy have left the Mouse feeling trapped By Abigail Iaconis, Capstone Senior Analyst The Walt Disney Corporation has one of the most iconic brand images on Earth. Founded as the humbly named Disney Brothers Cartoon Studio in 1923, the company …

2024 State of the Market Survey

2024 State of the Market Survey Near the end of 2023, Capstone Strategic, Inc., a Vienna, Virginia based consulting firm specializing in middle market Mergers and Acquisitions, reached out to nearly 700 current and former clients to collect their thoughts and opinions on the growth environment in their industry and how they felt about near-term …

Article | The shadows of what may or may not be in 2024

Capstone Partner John Dearing, CFA shares some thoughts on the year ahead for the credit union industry in a new article for CUInsight.com. Read the article here.

2023 Capstone Cares Comfort & Joy Holiday Food Drive

2023 Capstone Cares Comfort & Joy Holiday Food Drive Our 4th Annual Holiday Food Drive will be collecting items for Arlington Food Assistance Center (AFAC) beginning November 20. AFAC distributes nutritious groceries to families in need every week. A wish list of AFAC’s most needed items has been created on Amazon. Simply go to Amazon …

Article | “What MFG Can Learn From M&A” by David Braun

Capstone Founder and CEO David Braun is the author of an article in the current issue of “Manufacturing Outlook.” Read “What MFG Can Learn From M&A” at www.manufacturingoutlook.com/the-latest-issue/

Capstone Strategic Advises Achieva Credit Union on the Purchase of Cannella Insurance Services

Capstone Strategic Advises Achieva Credit Union on the Purchase of Cannella Insurance Services Capstone Strategic, Inc. (Capstone) announced today that Achieva Credit Union of Dunedin, Florida recently acquired Canella Insurance Services of Tampa. The acquisition took place through Achieva’s credit union service organization, Achieva Insurance Agency. Achieva was advised by Capstone throughout the prospect selection …

The Verdict in In the Sell Side: Who is the Ideal Buyer for Your Client?

The Verdict in In the Sell Side: Who is the Ideal Buyer for Your Client? By Brian Goodhart In the world of business transactions, it’s often said that the price is just the tip of the iceberg. In this last session of our ongoing series, “The Verdict is In on the Sell Side,” we delve …

Capstone Strategic Announces External Growth Program Partnership with CCUA

Capstone Strategic Announces External Growth Program Partnership with CCUA Capstone Strategic Inc. (Capstone) announced today the creation of an external growth program for credit unions developed in partnership with the Cooperative Credit Union Association (CCUA). The focus of the joint program is to offer external growth thought leadership and education to CCUA’s member credit unions, …

The Verdict is In on the Sell Side: Business Valuation Basics

The Verdict is In on the Sell Side: Business Valuation Basics By Brian Goodhart Valuation is a fundamental aspect of the complex and intricate world of mergers and acquisitions. It serves as the compass that guides decision-makers through the financial wilderness of corporate transactions. Today, we will delve into the intricate art and science of …

Article | If you want Gen Z members tomorrow, start reaching out to them today

Article | If you want Gen Z members tomorrow, start reaching out to them today Born between the years 1997 and 2012, the demographic given the moniker “Gen Z” now comprises more than one-quarter of the world’s population. Gen Z members are true digital natives, adept at sailing oceans of data. They have also made …

CU-nnecting Gen Z: The Next Generation of CUs

CU-nnecting Gen Z: The Next Generation of CUs Please join us on September 13 for our next credit union themed webinar, “CU-nnecting Gen Z: The Next Generation of CUs.” Join Capstone Partner John Dearing, CFA and his guest, 2aDays Founder and CEO Keirsten Sires as they discuss how credit unions can effectively reach out and connect with younger generations to expand …

The Verdict is In on the Sell Side- “The Responsibility of a Good Transaction Advisor”

The Verdict is In on the Sell Side- “The Responsibility of a Good Transaction Advisor” By Brian Goodhart – Director, M&A Advisory Services For many business owners, a transaction is a once-in-a-lifetime event, and stepping into this unfamiliar territory can be both exhilarating and overwhelming. This is where a seasoned transaction advisor steps in – …

The Verdict is In on The Sell Side: The Selling Equation

The Verdict is In on The Sell Side: The Selling Equation By Brian Goodhart In the world of business, transactions are often seen as a simple exchange of goods or services for money. However, beneath the surface lies a complex interplay of motivations, goals, and considerations that go beyond the price tag. This is where …

To Build a More Perfect Credit Union Association?

By John Dearing In the latest issue of CU Insight, Capstone Managing Director John Dearing, discusses the importance of Credit Unions taking steps to understand the benefits and risks of crypto. Access the article here: www.cuinsight.com/investors-havent-abandoned-crypto-and-neither-should-credit-unions/ I’m still feeling the aftershocks of the seismic shift that occurred with the announcement of the proposed merger between the two leading …

The Verdict is In On the Sell Side: Why Do Business Owners Sell

Why Do Business Owners Sell? While owning a business offers numerous benefits, such as financial rewards and a sense of fulfillment, there comes a time when factors like retirement, burnout, and a shift in risk tolerance prompt business owners to consider selling. In this article, we will delve into key insights shared during our recent …

Will Cava Going Public Set the Table for Other IPOs?

Will Cava Going Public Set the Table for Other IPOs? By David Braun, Founder and CEO, Capstone Strategic When Washington DC based restaurant chain Cava became a publicly traded company recently, it bucked a trend that has lasted nearly two years, a notable absence of American IPOs. The past 18 months have marked the slowest …

The Verdict is In on the Sell Side: An Honest Conversation about the Future of Your Business

The Verdict is In on the Sell Side: An Honest Conversation about the Future of Your Business By Brian Goodhart, Director, M&A Advisory services Over the next few weeks, I’ll be sharing a series of posts based on my webinar series “The Verdict is In on the Sell Side” where we aim to address the …

Investors haven’t abandoned crypto and neither should credit unions

In the latest issue of CU Insight, Capstone Managing Director John Dearing, discusses the importance of Credit Unions taking steps to understand the benefits and risks of crypto. Access the article here: www.cuinsight.com/investors-havent-abandoned-crypto-and-neither-should-credit-unions/

The Verdict is In on the Sell Side – First Session Available

Brian Goodhart, Director of M&A Advisory Services at Capstone, recently released his webinar series for legal professionals, “The Verdict is In on the Sell Side.” This six-part, monthly series was developed specifically for attorneys to assist them in guiding clients through the process of selling their business. The first session is now available: WATCH NOW …

Capstone Promotes Abigail Iaconis to Senior Analyst

Capstone is pleased to announce that Abigail Iaconis has been promoted to the position of Senior Analyst. In carrying out the duties of her new position, she will provide Capstone clients with creative solutions to issues which will help them overcome obstacles on their pathway to successful, inorganic growth. Abigail’s responsibilities will include conducting research …

Structure – The Final Variable in Your Selling Equation

Structure – The Final Variable in Your Selling Equation By Brian Goodhart The final component of Your Selling Equation is Structure. The very word gives me the chills as structure is such a big topic and covers so many potential areas. I often hesitate to treat it as a singular component because it’s just not. …

Operations – The Fourth Variable in Your Selling Equation

Operations – The Fourth Variable in your Selling Equation By Brian Goodhart The essence of the Operational component of your selling equation is the fundamental question of whether the owner’s departure upon sale would cause a material disruption in the performance of the business. In a perfect world, a business owner would be able to …

Timing – The Third Variable in Your Selling Equation

Timing – The Third Variable in Your Selling Equation By Brian Goodhart Timing, as they say, is everything. Well not exactly everything, but it is very important. And it is yet another deeply personal factor that comes into play whenever deals are contemplated. In my last post I discussed Involvement and how each business owner …

Involvement – The Second Variable in Your Selling Equation

Involvement – The Second Variable in Your Selling Equation By Brian Goodhart Involvement is perhaps one of the most complex and personal variables involved in the selling equation. Unlike valuation, there are no trained professionals in this field who use proven methods to arrive at a mathematically sound option. Involvement is inherently personal and as …