Capstone Strategic Announces External Growth Program Partnership with CCUA Capstone Strategic Inc. (Capstone) announced today the creation of an external growth program for credit unions developed in partnership with the Cooperative Credit Union Association (CCUA). The focus of the joint program is to offer external growth thought leadership and education to CCUA’s member credit unions, …

Tag: Credit Union

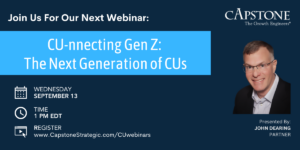

CU-nnecting Gen Z: The Next Generation of CUs

CU-nnecting Gen Z: The Next Generation of CUs Please join us on September 13 for our next credit union themed webinar, “CU-nnecting Gen Z: The Next Generation of CUs.” Join Capstone Partner John Dearing, CFA and his guest, 2aDays Founder and CEO Keirsten Sires as they discuss how credit unions can effectively reach out and connect with younger generations to expand …

Credit Unions: Valuation and M&A Transactions

Whether due to merger, expansion, or investment, an understanding of the processes and techniques of valuation is crucial for the effective growth and solid financial performance of credit unions. Capstone Managing Director John Dearing and Manager Anna Kochkina break down the multifaceted valuation process in CUInsight. https://www.cuinsight.com/credit-unions-valuation-and-ma-transactions.html

4 Ways to take your Credit Union to the Next Level

In today’s dynamic economic environment, credit unions continue to face regulatory challenges and competition from challengers as well as big banks with big pocketbooks. The industry actually experienced a membership decline last year. In order to thrive in this environment, credit unions must take a proactive approach to growth and seek new opportunities to expand. …

Is your credit union ready for the next recession?

Recession fears have grown in recent months. New CU performance data does hint that a slowdown is occurring. As of June 2019, CUNA estimates 5,529 credit unions were in operation, 21 fewer than May and 179 fewer than June 2018. During the first half of 2019, approximately 74 credit unions ceased to exist because of …

5 Reasons Millennials Should Join a Credit Union

Millennials are the largest living generation in the United States. Based on current projections, millennials are expected to overtake Baby Boomers in population as their numbers swell to 73 million in 2019. Research has shown that millennials care deeply about their local communities. We all know that credit unions are community-focused and provide excellent member service while …

Serving “overlooked” populations: An opportunity for credit union growth

It’s not uncommon for credit unions to work with non-traditional industries and financially-vulnerable populations. In fact, offering financial services to unbanked people such as recent immigrants and other disadvantaged groups dates back to the credit unions’ beginnings. The first credit unions were formed in Germany in the 19th century and were based on principals of self-help, equality, social responsibility …

5 Reasons Why Credit Unions Should Consider Partnerships with Big Data Companies in 2019

Big data is exactly what it sounds like – a vast amount of structured and unstructured information, collected from an increasingly diverse set of digital and traditional sources. For credit unions, every interaction with members, every loan processed, fee collected, call center, or branch interaction is an opportunity to collect data which when aggregated, becomes …